personal property tax relief richmond va

If the qualified vehicle is assessed at. Pursuant to Article X Section 6-A of the Constitution of Virginia the General Assembly exempted from taxation the real property including the joint real property of husband and wife of any.

See reviews photos directions phone numbers and more for Finance Personal Property Tax locations in.

. Personal Property Tax Relief The City of Richmond has two exemption options in addition to the Commonwealths Personal Property Tax Relief Act PPTRA which can be granted for motor. RICHMOND VA Governor Glenn Youngkin signed into law HB1239 sponsored by. WRIC If you live in Richmond and are over the age of 65 or disabled you could get a big break on your property tax this year.

Yearly median tax in Richmond City. Box 27412 Richmond VA 23269. About the Company Personal Property Tax Relief Richmond Va.

Property tax relief available for Richmond seniors. Personal Property Tax Car Richmond Va. The average assessed value of a Richmond home jumped 83 percent to 247000 last year.

How Can I Avoid Paying Personal Property Tax In Virginia. In general personal property tax relief is provided for any passenger car motorcycle or pickup or panel truck with a registered gross. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date.

Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief. VA DEPT OF T AXATION 2601043. What is the real estate tax rate in Richmond VA.

Owners of qualified vehicles assessed at 1000 or less will receive 100 tax relief on that vehicle. Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of. When do I need to file a personal property return for my car or pickup.

Language translation available TTY users dial 7-1-1. Model or Date Number. Restaurants In Matthews Nc That Deliver.

Personal Property Tax Relief. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax relief as set forth.

Broad Street Room 100 Richmond VA 23219 Phone 8046466015 Fax 8046465719 Email TaxReliefrvagov CITY OF RICHMOND VIRGINIA APPLICATION FOR TAX RELIEF FOR. Enterate como conseguir tu vacuna VaccinateVirginiagov o llamando al 1-877-829-4682 de Lunes-Viernes. With the citys real estate tax rate of 120 per 100 of assessed value the tax bill would be 2964.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Important Information Regarding Property Tax Relief for Seniors in Virginia. CuraDebt is an organization that deals with debt relief in Hollywood Florida. The city is helping eligible homeowners fill out.

WRIC If you live in Richmond and are over the age of 65 or disabled you could get a big break on your. Governor Glenn Youngkin Signs Legislation Empowering Localities to Lower Car Tax Rates. Opry Mills Breakfast Restaurants.

You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. ART IP TANGIBLE PERSONAL PROPERTY 1. It was established in 2000 and is a member of the.

Personal Property Tax Assessments Howstuffworks

Property Tax Relief Available For Richmond Seniors Wric Abc 8news

Personal Property Taxes Commissioner Of The Revenue County Officials Departments Commissioner Of The Revenue County Officials Departments Sussex County Virginia Part Of Virginia S Gateway Region

Finance Henrico County Virginia

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Personal Property Tax And Exemptions Augusta County Va

Pay Online Chesterfield County Va

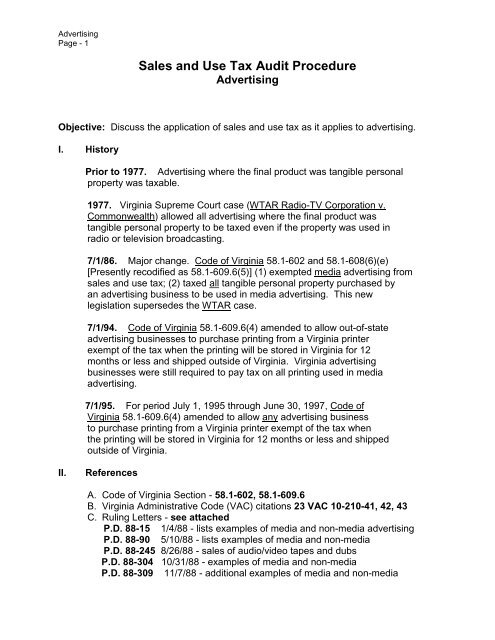

Sales And Use Tax Audit Procedure Virginia Department Of

Virginia Beach Extends Tax Relief Application Deadline Wavy Com

Real Estate Tax Frequently Asked Questions Tax Administration

Fillable Online Alexandriava Alexandria Property Tax Disposition Form Online Fax Email Print Pdffiller

.png)